Future Now

The IFTF Blog

There Could Be a Real Solution to Our Broken Economy. It’s Called ‘Universal Basic Assets.’

![]()

Marina's article reposted from Medium

“The marketplace in which most commerce takes place today is not a pre-existing condition of the universe,” says author and Institute for the Future fellow Douglas Rushkoff. “It’s not nature. It’s a game, with very particular rules, set in motion by real people with real purposes.”

Over the past 100 years such rules have fostered unprecedented economic growth. However, today they are also producing deeply damaging social and ecological outcomes.

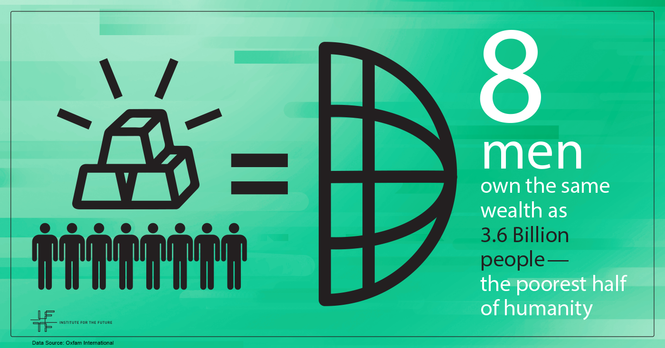

The numbers are striking. In 2010, 288 of the richest people in the world collectively owned as much wealth as the bottom 3.5 billion people. Last year, according to a recent study by Oxfam International, just eight people owned as much wealth as half of the world’s population.

In this moment of massive wealth inequality?,? we urgently need to develop a new model for society to deliver both social and economic equity.

The answer may be in the concept of Universal Basic Assets (UBA), which in my definition is a core, basic set of resources that every person is entitled to, from housing and healthcare to education and financial security.

It Can Get Worse

The social instability caused by vast economic disparities is likely to only grow deeper under the pressure of two forces.

The first is the unrelenting progression of global warming that is already driving massive migrations of climate refugees due to wars, water and food shortages.

The second force—rapid advances in automation, artificial intelligence, and machine learning—is undermining traditional sources of income for vast swaths of populations in developed and developing countries alike.

A whole set of new technological tools, from networking to machine learning to robotics, are making it possible to produce goods and services in abundance without employing large numbers of workers. Growing numbers of people are making livelihoods in various types of flexible yet precarious employment arrangements rather than in stable, well-paying jobs that come with essential social benefits and risk protections.

As a result, the system that worked relatively well under conditions of scarcity is poorly suited to fulfill the needs of many when products and knowledge can be produced in abundance by relatively few.

A Framework for Equity

We urgently need to design a new framework that delivers greater social and economic equity. Some economists and activists are proposing Universal Basic Income, a guaranteed minimum payment for everyone, as a way to ensure a guaranteed minimum for people to live on. We believe that a universal basic income is only the first step in making our economic system more equitable.

French economist Thomas Pikkety, author of the best-selling book, Capital in the Twenty-First Century, documented that in this point in history, it’s impossible for a person simply earning a salary to see the same economic returns as investors and capital owners secure through their assets.

Such disparities are likely to grow ever larger as the result of automation. An enterprise with fewer workers can reward owners with larger profits. As a result, solutions to economic inequality need to address more equal access to primary assets that generate better economic and social outcomes.

New Assets, New Rules

New Assets, New Rules

In designing Universal Basic Assets we take into account access to traditional physical and financial assets like land and money, as well as the growing pools of digital assets (data, digital currencies, reputations, etc.). We also recognize and assign value to exchanges we engage in as a part of maintaining the social fabric of our society but that do not currently carry with them monetary value (caring, creative output, knowledge generation, etc.).

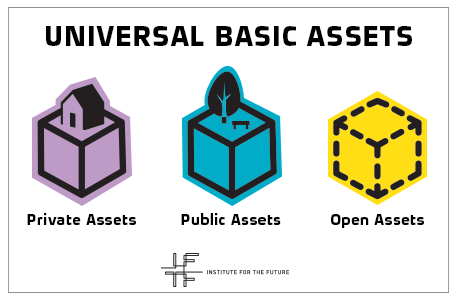

In essence, we need to look at the concept of assets in its broadest sense, considering three classes of assets: private, public, and open.

Private Assets

Private assets are resources that we own individually. Housing, land, personal money, and retirement accounts fall into this category.

Since the 18th century, thinkers across the political spectrum have been advocating for equitable access to private assets, with some focusing on redistribution of incomes in the form of various types of taxes in order to achieve greater economic equity (Universal Basic Income comes under this umbrella). Others frame the issue around equal access to opportunity—that is, giving people a more equal starting point for achieving economic and social mobility. In this latter category, legal scholars Bruce Ackerman and Anne Alstott, for example, propose creation of The Stakeholder Society by granting a one time lump sum payment of $80,000 to everyone upon reaching the age of maturity. The UK’s Child Trust and efforts to create Individual Development Accounts (IDA’s) in the U.S. similarly aim to give children a head start while helping them understand personal finance and the importance of saving for and investing in the future.

Public Assets

Public assets include resources collectively owned by the public and are managed by different types of government bodies on their behalf. They can include everything from national parks to mineral and cultural resources to critical parts of physical or digital infrastructure.

The four countries that have consistently been at the top in global rankings of social mobility are Denmark, Norway, Finland, and Canada. What they have in common is a high level of access to public resources like education, healthcare, and transportation.

If you are born to a poor family in Denmark, your chances of attaining economic success are not that different than those of your peers born into wealthier household.

Access to a whole variety of public assets makes it possible for children in countries like Denmark and Finland to move up the social and economic ladder independent of where they start.

In the United States, by contrast, your socio-economic status at birth is a big determinant of how well you will do as an adult.

Within the U.S., access to public resources accounts for regional differences in socio-economic mobility. Children born to families at the bottom fifth of the income distribution, have a 10 percent chance of reaching the top fifth of income levels during their lifetime if they live in San Francisco, New York, or Boston. The chance for the same children living in Charlotte, Columbus, or Atlanta is 5 percent, and for those from Memphis, only 2.8 percent. This is largely due to lower access to public schools, transportation, healthcare, and, of course, well-paying jobs. Being born poor dooms you to staying poor.

Open Assets

Open assets are resources that are owned and managed neither privately or by a government. They are open to anyone and governed by a defined group.

Open assets are created in what MIT Media Lab researcher and IFTF affiliate John Clippinger calls the “open sector.” According to Clippinger, in the open sector, a group of “founders” create a set of initial conditions from which rules emerge through the interactions of participants.

Clippinger cites the example of the British Common Law, a basis for America’s legal system, which evolved from customs and norms, and was eventually codified into constantly evolving laws. “It wasn’t top-down. It was constantly reinventing itself around the circumstances, and there was no single point of control,” he says. This is how the open software community operates today. Wikipedia is another familiar example of a community bound by common practices and principles that has established an architecture and a set of practices for entering and editing information, which in turn, has made it possible to create an open resource used by billions of people worldwide.

In the analog domain, we find examples of open systems for value creation in physical communities such as Burning Man or Freespace, where no money is allowed. People choose to come together freely and exchange or gift each other anything from physical goods to knowledge and services. This model is probably the form of existence most familiar to us as a human species as this is how many of our human ancestors lived before we invented money and market capitalism.

However, we don’t have to participate in the open-source software movement or go to Burning Man to experience non-monetary, non-profit-based economies—we participate in them on a daily basis in many ways. We don’t pay for love, for dinners at our parents’ homes, for our child’s affection, for art and music and other creative outputs that have become invisibly woven into the infrastructure of our daily lives (if we are lucky). As we transition to new forms of value creation we have opportunities to enlarge our pool of open assets and reconsider how and what we assign value to.

However, we don’t have to participate in the open-source software movement or go to Burning Man to experience non-monetary, non-profit-based economies—we participate in them on a daily basis in many ways. We don’t pay for love, for dinners at our parents’ homes, for our child’s affection, for art and music and other creative outputs that have become invisibly woven into the infrastructure of our daily lives (if we are lucky). As we transition to new forms of value creation we have opportunities to enlarge our pool of open assets and reconsider how and what we assign value to.

In the face of rising economic inequality in a society where those with capital get richer far faster than those who labor, we need to focus attention on more equitable distribution and access to a variety of assets. This would ensure not only greater socio-economic mobility for individuals but also help sustain the social fabric of our society.

Let us not forget that high levels of economic inequality come at a price not only for the poor but also for the extremely wealthy themselves. Some are building protective bunkers on secluded islands as they prepare for the inevitable social upheavals. Historical research shows that any concentration of wealth and power requires investments in vast networks of expensive security institutions leading to what Dr. Rachel Kleinfeld calls privilege violence. Such violence stems from a “power structure that allows or enables violence against some citizens as the price for maintaining extreme privilege.”

Creating a new kind of economy based on Universal Basic Assets can enrich all of our lives. Without it, the future may be a much poorer place for everyone.

For more on this topic, please read the IFTF working paper “Universal Basic Assets: Manifesto and Action Plan” (PDF).