Future Now

The IFTF Blog

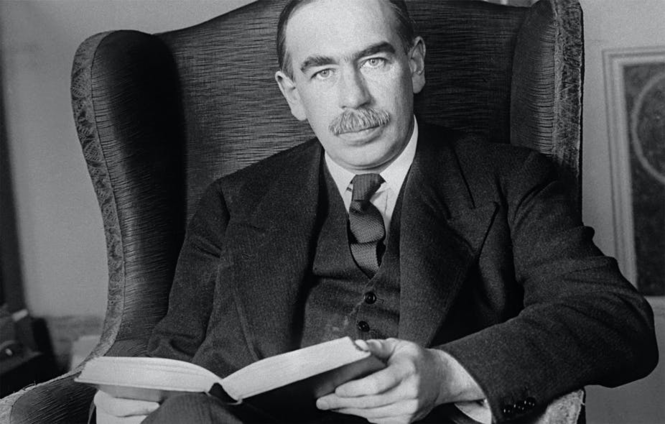

Looking 100 Years Into the Future: Lessons from John Maynard Keynes

“We are suffering from a bad attack of economic pessimism. It is common to hear people say that the epoch of enormous economic progress is over and that a decline in prosperity is more likely in the decade that lies ahead of us.”

Sound familiar? The negative sentiment captured above can be found in many quarters today as the world recovers (slowly) from a deadly epidemic, wrestles with widening inequality, and worries about automation, AI, and climate change. But the paragraph above wasn’t written in 2022. It was written in 1930 by the leading economist of the 20th century, John Maynard Keynes, in an essay titled, “Economic Possibilities for Our Grandchildren.”

At the height of the Great Depression, Keynes wanted to offer some much-needed assurance: The world is simply going through the growing pains of “over-rapid changes.” Yes, technology will sometimes displace workers faster than the economy can reabsorb them. But technological unemployment, as he called it, is a normal state of affairs and would be short-lived.

That doesn’t mean Keynes counseled inaction. Indeed, the prevailing view of most economists at the time was to let the free market pull itself out of economic downturns. But Keynes went against conventional wisdom and argued for governments to play an active role—spend money you don’t have, create jobs, cut taxes, and do whatever you can to boost demand. His book, The General Theory of Employment, Interest and Money (1936), provided the first theoretical justification for counter-cyclical deficit spending. Governments listened. The book quickly launched a revolution in thinking that swept through most capitalist economies.

Only in the 1980s did Keynesian economics fall out of favor when monetarists like Milton Friedman had the ears of Ronald Reagan and Margaret Thatcher. But the Keynesian worldview seems to have made a comeback. We see its thumbprint in the $1+ trillion bailout during the 2008 Great Recession and the more recent COVID relief. In 2020, OECD nations issued $18 trillion in debt to mitigate effects of the pandemic, nearly 70 percent of that in the U.S. alone. (I recommend listening to Ezra Klein’s podcast episode “Covid Showed Us What Keynes Always Knew” produced by The New York Times.) Those responses were quintessentially Keynesian.

But Keynes’ name is invoked more and more these days for other reasons as well. His 1930 essay, “Economic Possibilities,” offered a radical vision for what the world will be like 100 years into the future. Many are wondering if his predictions for 2030 will pan out.

In that essay, the reason for his optimism during the Great Depression had very little to do with it being presumably transitory. Rather, it was based on his unapologetically utopian belief that our economic problems will be solved once and for all, not through revolution but as a natural consequence of carefully guided capitalism. By 2030, he believed, we will have increased our standard of living four to eight-fold. Technological progress will allow us to produce the same things with “a quarter of human effort.” And most of us will work maybe three hours a day or fifteen hours a week. Not only that, once our basic needs are easily met, our morals will advance and we will find the love of money to be disgusting, semi-criminal, and semi-pathological. There will still be people who pursue money for its own sake but they will no longer command the same admiration they used to enjoy.

“I draw the conclusion that, assuming no important wars and no important increase in population, the economic problem may be solved, or be at least within sight of solution, within a hundred years”.

John Maynard Keynes’ long-term thinking when it came to economics afforded him optimism and seeing a world of possible outcomes.

With eight more years to go before 2030, how right was he?

According to his biographer, Zachary Carter, Keynes is not too far off on some of his numbers. In his book about Keynes, The Price of Peace, he cites economist Joseph Stiglitz who shows that global economic output has already reached a level that could lift everyone above the U.S. poverty line. Carter also cites another economist, Harvard’s Benjamin Friedman, who shows we are on track to that eight-fold increase in U.S. standard of living by 2029.

But none of that means everyone will have their economic needs met. If Keynes underestimated anything (aside from the world’s population), it’s the challenge of distribution. That particular economic problem—how to distribute what we produce equitably —isn’t close to being solved, and probably not in the next eight years.

Our widening inequality suggests Keynes may also have vastly underestimated how much humans will have to work in 2030. That said, even if most of us continue to need full-time jobs, that doesn’t mean the need for human labor won’t decrease in the coming years as automation and artificial intelligence disrupt every sector and profession. On this front, many governments today are starting to worry about what to do if Keynes is proven right.

Whatever his hit rate, what can we glean from John Maynard Keynes’ attempt, in this one essay, to see 100 years into the future? What lessons can futurists draw?

1) Resist Present-Day Pessimism

Even when—or especially when—nothing is going right, we have to turn our gaze to the future. Or else the present will blind us to the “true interpretation” of things. Keynes believed we need to use foresight to challenge the pessimism of both revolutionaries who despair that nothing will change as well as reactionaries who fear we can’t risk change. When everything seems hopeless, Keynes would counsel, “take wings to the future.”

2) The Future Is Deeply Human

In Keynes’ future, humans are not economic entities striving for subsistence. They are complex beings who face a new problem, one he calls “the permanent problem of the human race”—how to use one’s freedom, “how to live wisely, agreeably, and well.” What will guide us as we peer far into the horizon are not economic trend lines but deep insights into human nature. (As a gay man who later fell in love and married a famous ballerina, he knew just how complex human psychology can be.) The fundamental needs of humans for meaning, purpose, and belonging will always shape our futures, however distant or near.

3) Live the Future Today

We will not arrive at “economic bliss” easily. Humans have spent too much time striving for subsistence to know other ways. When Keynes looked at how the wealthy class used their freedom, he thought “most of them failed disastrously.” Nevertheless, he believed with a little more experience, we will eventually learn how to live better. It’s important that we begin “making preparations for our destiny” by starting to experiment in what he calls “activities of purpose.” First, we need to reframe economics, which he tried to do in his essay and other writings, so that we start to prioritize the “art of life” over the “means of life.” It’s worth noting that many of his students at Cambridge remembered him fondly as a philosopher first, an economist second. One even described his economic treatise, The General Theory, as nothing less than a “Manifesto for Reason and Cheerfulness.” He was cheerful all right. Though he lived through both world wars, his optimism in the human spirit never waned. It shines through clearly in his biblically poetic vision of the world in 2030:

“We shall once more value ends above means and prefer the good to the useful. We shall honour those who can teach us how to pluck the hour and the day virtuously and well, the delightful people who are capable of taking direct enjoyment in things, the lilies of the field who toil not, neither do they spin.”

Perhaps none of us would bet money on this future coming true anytime soon. And it may never will. Keynes had many critics in his own time; some found him to be “tragically naive.” But like most futurists today, Keynes lived in the world of possibilities and chose radical optimism, which only long-term thinking allows. The way Keynes saw it, “In the long run, almost anything is possible.”